Benefits and Credits For Newcomers

In Canada, taxes make many services and benefits available. The collected tax money helps newcomers, lower income families, students, seniors, and people with disabilities.

To receive the Canada Child Benefit and the GST/HST Credit, you must

- be a resident of Canada for tax purposes

- have a valid social insurance number (SIN)

You are considered a resident of Canada for income tax purposes if your home is in Canada, you have a spouse or common law partner in Canada, or have children in Canada. You also have personal property in Canada (car, furniture), economic ties (Canadian bank accounts, credit cards), a Canadian driver’s licence or passport, health insurance in Canada, or social ties (membership to Canadian recreational or religious organizations).

Canada Child Benefit

The Canada Child Benefit helps families raise children under 18. This is a tax free monthly payment. You can get up to $6997 for each child under 6 and up to $5903 for each child aged 6-17.

The Goods and Services/Harmonized Sales Tax Credit

The GST/HST credit helps people with low or modest income. This tax free payment offsets some or all of the GST or HST you pay. Eligible individuals can receive up to $467 and eligible families can receive up to $934.

Look at this poster for more information on the Canada Child Benefit and the GST/HST credit.

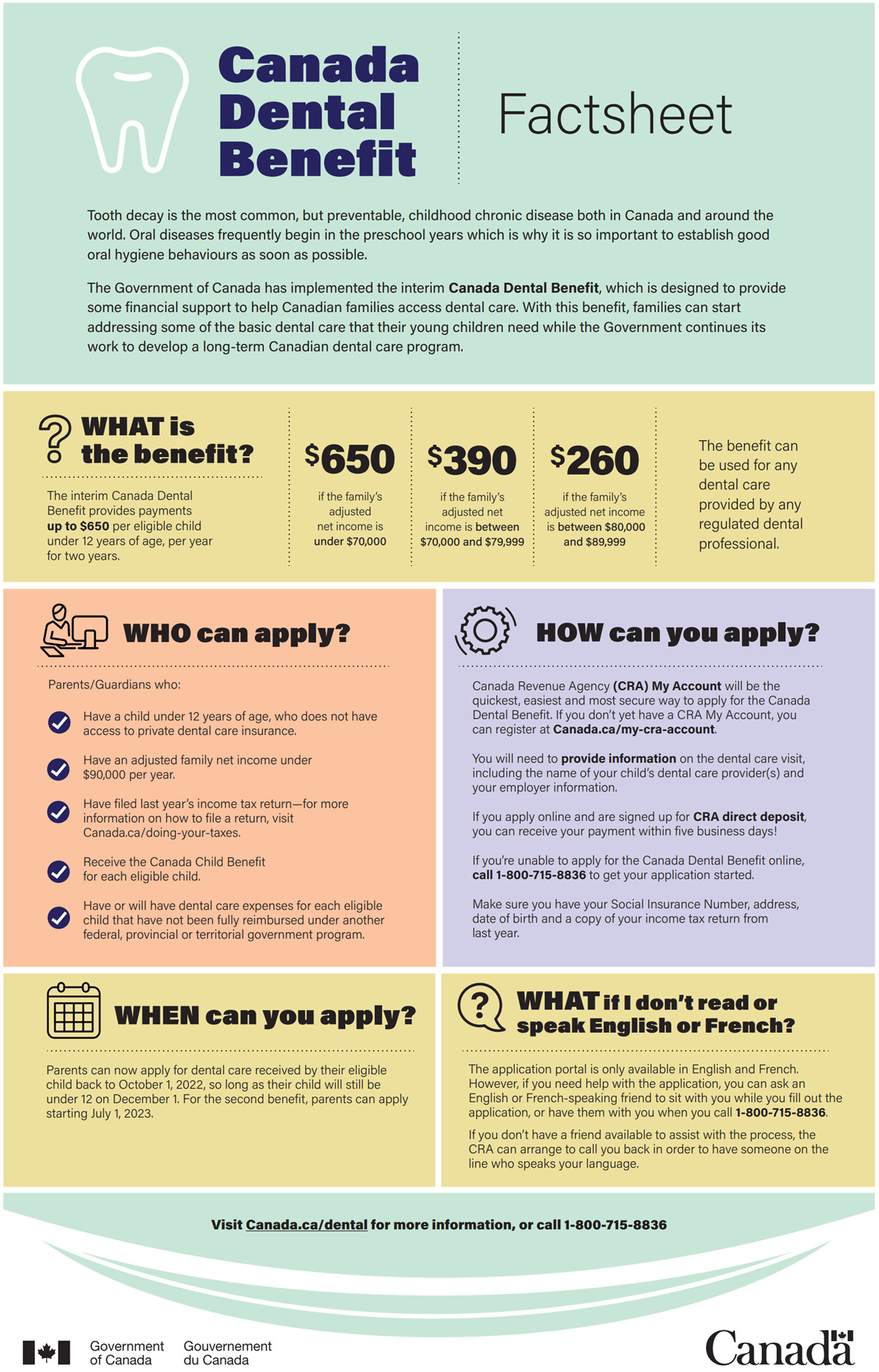

Canada Dental Benefit

The Canada Dental Benefit is a temporary benefit to lower dental costs for eligible families. It is for families earning less than $90 000 per year. The child receiving dental care must be under 12 and not have access to a private dental insurance plan. You can receive up to 2 payments of up to $650 per child. The first benefit period ends June 30, 2023 and the second is from July 1, 2023 to June 30, 2024. Click here to check your eligibility, find out how much you can get, and apply.

One Time Top-Up To The Canada Housing Benefit

This one time benefit is a $500 payment to help low income renters. It can be added to the Canada Housing Benefit. Applications are open until March 31, 2023. You can find out more here.

There are many benefits to help you in Canada. To receive benefits, you must do your taxes by April 30 each year. If you’d like help doing your taxes, the Burnaby Neighbourhood House is running a free tax clinic. You must be a member of the Burnaby Neighbourhood House. Check your eligibility and apply here.